personal income tax malaysia

You can also refer to the. Salary of PHP 652000 living allowances of PHP 100000 and housing benefits 100 of PHP 300000.

Malaysia Personal Income Tax Guide 2020 Ya 2019

Individual - Sample personal income tax calculation Last reviewed - 14 July 2022.

. In such instances tax residents will be exempted from paying personal income tax in Malaysia. An individual is regarded as tax resident if he meets any of the following conditions ie. Foreign tax credit for WHT on dividends assume 10 of 7030 70300.

This tax is 5 of the excess of the total net taxable income over USD 500000 limited to 33 of their personal and dependents exemption plus USD 8895. Tax rates range from 0 to 30. The general income tax base comprises all categories of taxable income ie.

Typical tax computation for 2021 Assumptions. 25 special tax on interest and 275 on dividends. The graduated tax rates.

If you are filing your taxes Everything You Should Claim For Income Tax Relief Malaysia 2021 YA 2020. Lets make sure you know how to declare yours properly. Income tax filing for sole proprietors is straightforward.

Sole earner 66900 Less. Personal Income Tax Copy link. 8 tax on gross salesreceipts and other non-operating income in excess of PHP 250000 in lieu of the graduated income tax rates and percentage tax business tax or.

Business income subjected to graduated tax rates shall also be subject to business tax ie. Personal income tax rates. Income tax liability.

Number of calendar months the employment was performed. Instead of filing Form BE which is filed by individuals under employment or having non-business income sole proprietors file Form B before 30 June on a yearly basis. Withholding tax WHT rates.

In Malaysia for a period of less than 182 days during the year but that period is linked to a period of physical presence. 12 VAT or 1 percentage tax as applicable. Malaysia Income Tax Brackets and Other Information.

For the purpose of this calculation it is assumed that pension is calculated at 8 of gross income and no NHF deduction. Costa Rican-source income is understood to be any income derived from assets used goods located or services rendered within Costa Rican territory. General income and personal income.

Second if the period of employment in Malaysia does not exceed 60 days per. Personal income tax PIT due dates. Capital income is generally taxed at a flat rate of 30.

Personal income tax filings may be done on paper or onlineFor income derived from hiring out property liberal professions and all income that falls. However such individuals may obtain a partial refund of taxes by filing an income tax return where they have incurred deductible business or special expenses or did not have a constant salary for 12 months. The tax year for personal income tax is the calendar year ending December 31 and tax filings and payments must be completed by March 31 of the following year PND 90 or 91.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021. Taxable income BBD Tax on column 1 BBD. First not being defined as a fiscal resident.

In Malaysia for at least 182 days in a calendar year. A non-resident individual is taxed only on income arising in Barbados and is not entitled to personal deductions against income. Individual - Sample personal income tax calculation Last reviewed - 28 July 2022.

An exception applies if the employees is working in Sweden for less than 15 days in a row and less than 45 days in total during a calendar year. Transportation credit 40000 Income tax. How To Declare Rental Income In Malaysia.

Individuals for whom employment income subject to wage tax is the only source of income are not obligated to file income tax returns. Non-residents are liable only for the applicable withholding taxes WHTs depending on the nature of the local income. Vietnams Law on Personal Income Tax recognizes ten different categories of income with a host of different deductions tax rates and exceptions applying to each of them.

Individual tax calculation for fiscal year ending 30 June 2022 Assumptions. Where the taxable income of a resident exceeds FJD 50000 income tax is FJD 3600 plus 20 in excess of FJD 50000. There are no local taxes on personal income in Turkey.

Social security contributions. Income from employment business and capital. A tax resident is defined as someone residing in Vietnam for 183 days or more in either the calendar year or a period of 12 consecutive months from the date of arrival.

Below is a list of personal income tax reliefs for filing in YA2021. Taxation of certain income from certain financial instruments as explained in the Income determination section are carried out by withholding tax WHT and the rates are 0 10 15 or 18 depending on the type of income and instruments. The Norwegian income tax system for individuals is based on a dual tax base system.

For 13th and 14th salaries 62000 51478. Malaysia Personal Income Tax Guide 2021 YA 2020 Jacie Tan - 25th March 2021. General income is taxed at a flat rate of 22.

Individuals who own a property in Malaysia that isnt used for business purposes and receive a rental income are subject to income tax. Individual - Sample personal income tax calculation Last reviewed - 05 July 2022. Expatriates may benefit from a special tax regime exemption on their income if the following two conditions are verified.

See Capital gains and investment income in the Income determination section for more information. The tax rate is 25. Below is the basis of PAYE calculation for an individual whose gross income is NGN 4 million.

This is the income tax guide for the year of assessment 2020. According to Section 45 of Malaysias Income Tax Act 1967 all married couples in Malaysia have the right to choose whether to file individual or joint taxes. Tax residence status of individuals.

The tax-filing spouse cannot claim spouse relief of RM3000 or the further relief of RM3. Filing a personal income tax return. Husband and wife will each be entitled to their own personal relief and other reliefs.

Salary and allowances of husband arising from employment. Value-added tax VAT rates. Capital gains tax CGT rates.

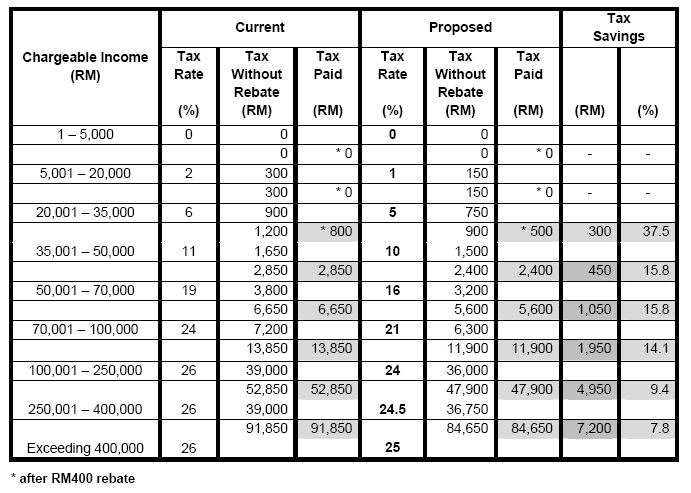

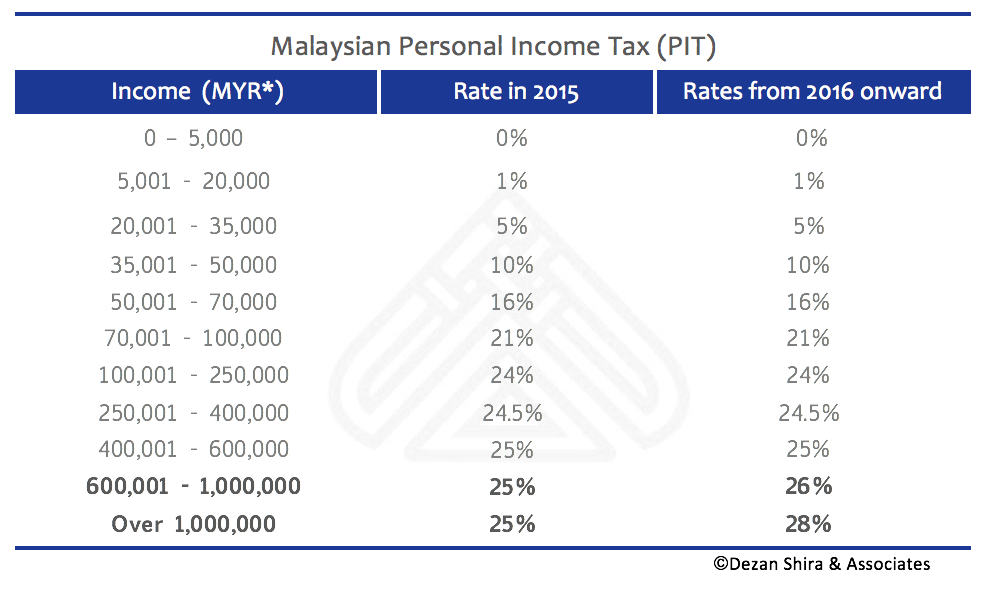

21 for the following EUR 6000 to EUR 50000 of taxable income. For resident taxpayers the personal income tax system in Malaysia is a progressive tax system. In addition to income tax social responsibility tax SRT and environment and climate adaptation levy ECAL are imposed on chargeable income.

Taxpayer is an expatriate employee who is resident in Botswana. For information on the 2022 Polish tax rates please see the Taxes on personal income section. In this case the taxpayer may choose to apply the tax regime for non-taxable excess amounts instead of this tax exemption.

This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. Alternate basic tax ABT In addition to the regular income tax individuals are required to compute an ABT assessed in accordance to the below tax table. Resident alien husband and wife with two dependent children.

19 for the first EUR 6000 of taxable income. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Personal income tax PIT rates.

In the case of non-residents income tax is 20 of the taxable income. In the process of filing Form B a sole proprietor needs to prepare various information to determine the chargeable. Personal income tax rates Self-employed individuals.

Savings taxable income is taxed at the following rates.

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

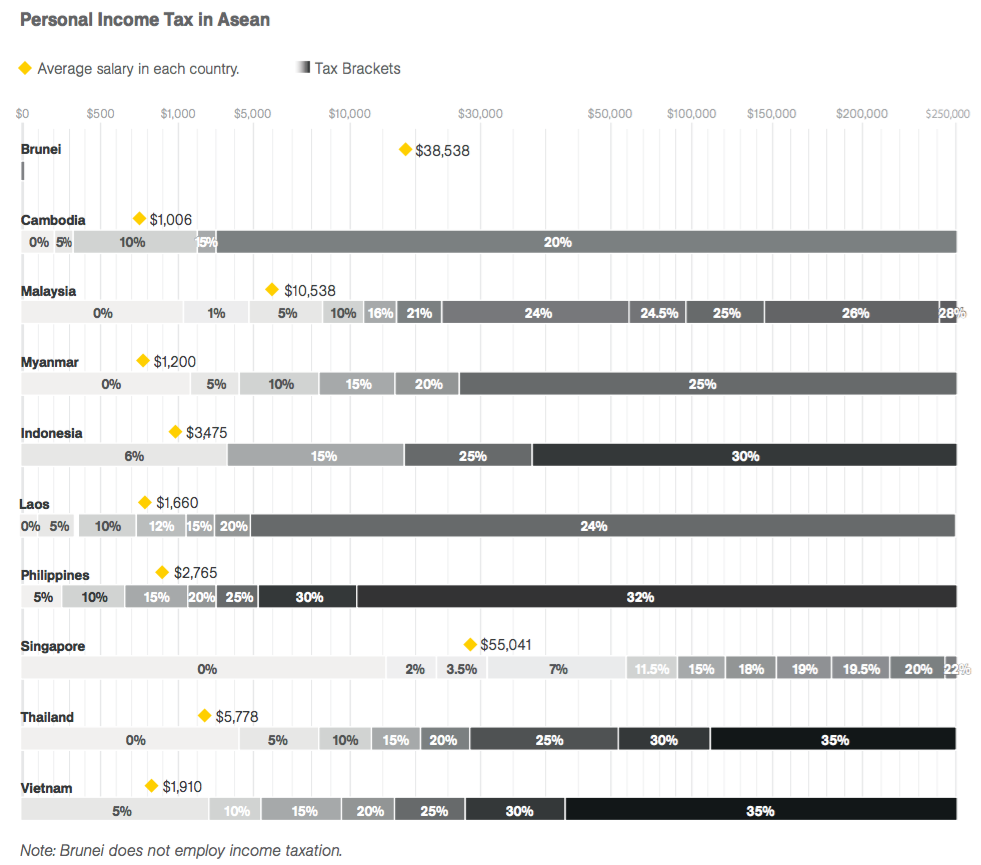

Screen Shot 2016 02 14 At 2 35 35 Pm Asean Business News

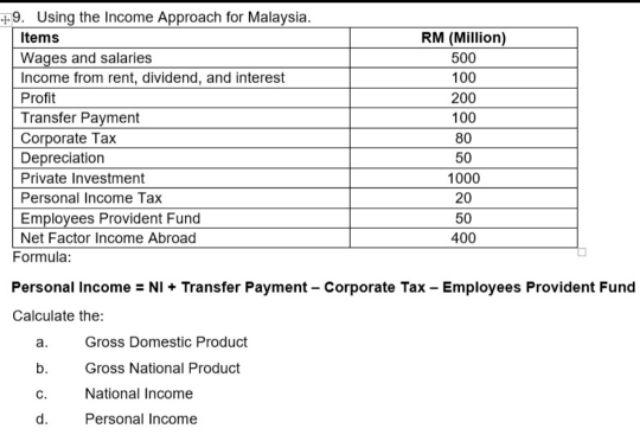

Solved 4 Usina The Income Annroach For Malavsia Personal Chegg Com

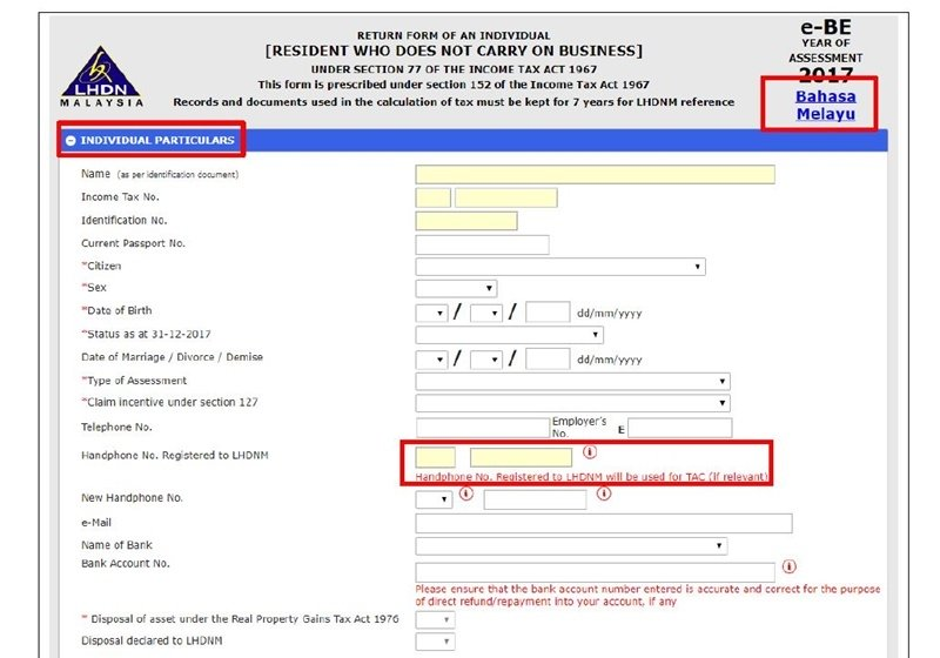

Electronic Filing Of Personal Income Tax Returns In Malaysia Determinants And Compliance Costs Semantic Scholar

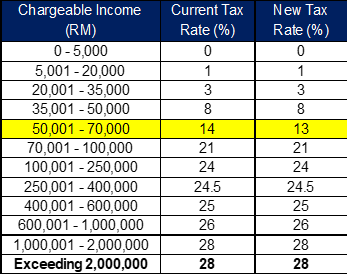

St Partners Plt Chartered Accountants Malaysia Personal Income Tax Rate For Ya 2020 2020年个人所得税税率 Facebook

Finance Malaysia Blogspot 2016 Personal Income Tax Relief Figure Out First Before E Filing

Malaysia Personal Tax Relief Ya 2019 Cheng Co Group

Budget Highlight 2021 Taxletter 26 Anc Group

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Personal Income Tax Archives Tech Arp

Personal Income Tax Asean Asean Business News

Malaysia Personal Income Tax Guide 2020 Ya 2019

Income Tax In Malaysia For Foreigners Tax Rate Tax Filing Process

The Complete Income Tax Guide 2022

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

Finance Malaysia Blogspot Ya2017 Tax Relief For Personal Income Tax Filing

How To Calculate Foreigner S Income Tax In China China Admissions

Comments

Post a Comment